Webinar: Using Care Coordination to Reduce Healthcare Costs

In this webinar:

Problem:

- Our healthcare delivery system is confusing and healthcare consumers are left on their own to navigate the system with minimal resources and tools

- Research shows 50% of people are confused, 24% of services are duplicated, and 61% of people self -refer and get it wrong…all of which leads to additional unnecessary cost

- People don’t trust insurance companies, and only 10% will ever bother to call or engage

- Insurance company call centers spend less than 1.5 minutes on each call and are not equipped or empowered to help people navigate the system, nor do have the tools or clinical resources to provide guidance

- Insurance companies have no incentive to help control healthcare costs for their clients

- Traditional programs try to engage members in clinical programs on average 100 days after a claim is processed and when they hit a threshold of 50% of a stop loss deductible, for example $75K. By then it’s too late to impact their care

Solution:

- Simplify the member experience and use the call center and provider information as a strategy to build trust and engage with the members at the time they need help

- Use the provider data (referrals, pre-certifications) as a trigger to work with the members in real time to help them have a better experience, connect them with experts and clinical resources and stick with them through the process

- Allow the care coordinators to take all the time needed to help people get guide people with the proper resources, tools, and education to get the most out of their benefits (typical call time over 7.5 minutes per call)

- 88% of people with claims over $10K are identified and engaged with a care coordinator 57 days before a claim is paid

- Have a technology platform that provides all of this information in real time to enable compassionate people the tools needed to give this level of care coordination and world class member satisfaction

Results:

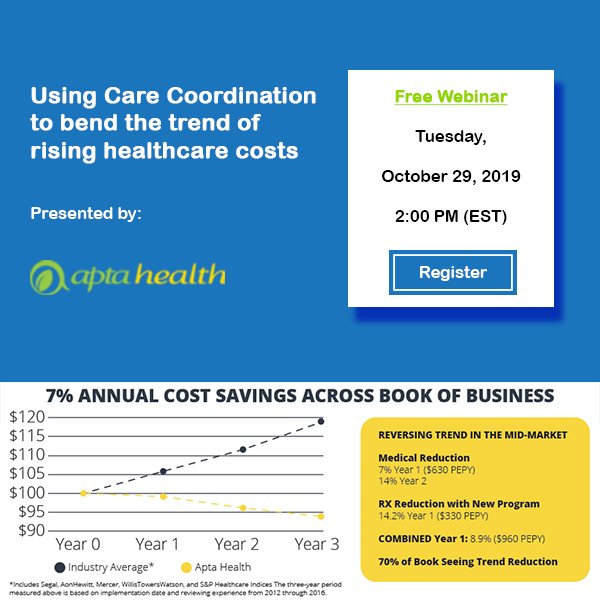

- Proven model with 17 years of independent validated savings with an average 16 year trend of 2.6% compared to industry trend of 8.8%

- Clients experience an average trend of 2.3% over each of their first 3 years, compared to industry averages of 6.3%

- 61% of members are actively engaged compared to 10% with traditional models

- Highest member satisfaction in health insurance, 74 net promoter score when compared to 18 health insurance average

- 90% client retention rate

- Proven long term sustainable strategy embraced by Fortune 500 clients, now exclusively available thru Apta Health for smaller companies