Is Your Business Ready to Respond to IRS Notices?

The Internal Revenue Service (IRS) has been sending out letters to employees that have not complied with the Affordable Care Act (ACA) reporting requirements. With the IRS sending notices to employers, and enforcement of these penalties set to continue through 2018 and beyond, it is important to understand what penalties can be assessed and why.

IRS Penalty Conditions:

The IRS is sending letters to employees identified as potential Applicable Large Employers (ALE) that have not filed Forms 1094/1095-C for a specified year.

You may be subject to an IRS penalty if at least one full-time employee received a premium tax credit and any of these conditions apply to your business:

- Failed to offer coverage to full-time employees and their dependents

- Offered coverage that was not affordable

- Offered coverage that did not provide a minimum level of coverage

What Penalties Can the IRS Assess?

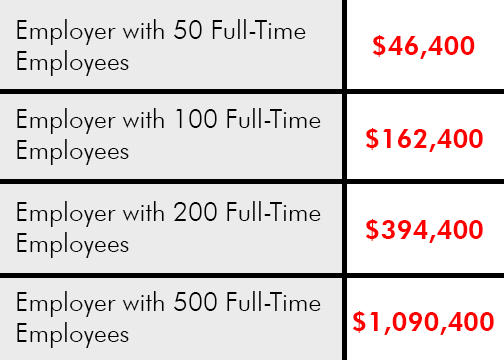

Applicable Large Employers risk being assessed penalties for not offering minimum essential coverage to at least 95% of full-time employees and their dependents:

To find out if you are at risk or if you would like assistance staying compliant, please Contact Us!